HODL Inc.

Strategy, DATCOs and a New Economy Backed by Bitcoin

I first met Phong Le, the then COO of MicroStrategy, in 2021 in a virtual meeting while I served as a staffer on Capitol Hill. MicroStrategy was a midsized software company that worked to provide cloud computing and business intelligence solutions for a wide variety of corporate clients. His team reached out because I was heading technology policy for Senator Cory Booker at the time, and I assumed we’d likely talk about artificial intelligence or chip manufacturing legislation. Unexpectedly, the entire conversation was about Bitcoin.

Phong introduced the work his boss, Michael Saylor, had done evangelizing the merits of the digital asset as a store of value and a hedge against inflation and explained their new business strategy of using the companies cash to aggressively acquire as much BTC as possible.

MicroStrategy had created the world’s first company of its kind, and was betting the entire future of the enterprise on the lasting value of the token.

Though they didn’t know it, I was particularly well suited to engage in this conversation as I’d already created, and subsequently folded, a venture of my own that endeavored to buy and hold digital assets as a bet on the future. My company, Lucrum Verus Capital, was nowhere as large or as bold as MicroStratey (and nowhere near as well capitalized) but I had some frame of reference to build off of. At LVC we utilized a partnership structure to build one large diversified fund of crypto assets. In 2017, while developing the idea, and in 2018, when we launched, it was still relatively complicated to acquire and safely custody a wide variety of digital assets, particularly newer ones, and we thought LVC might provide a simple solution to these problems. Quickly, operations became regulatorialy challenging and unfortunately we, like many others, ran into frustrating and unfair difficulties maintaining business banking relationships. So after about a year of operation; we closed shop.

My personal experience led me to think Saylor was crazy. Markets, in general, are unpredictable, and the digital asset market, in particular, was completely erratic and prone to severe and prolonged drops in value. But I believed then, as I do now, in the long-term value proposition of crypto. I just thought that it was insane to bet the health of a public company on a BTC accumulation strategy. Boy was I wrong.

Drop the ‘Micro’: It’s Cleaner

Over the next several years, which included a severe BTC price downturn in 2022, MicroStrategy — now rebranded as the considerably more macro ‘STRATEGY’ — has become a wildly successful enterprise worth much much more than it was in 2021. Le is now the CEO of Strategy and Saylor has graduated to Executive Chairman, where he can focus fully on communicating about the wonders of BTC and how to accumulate more.

Strategy now uses a variety of tactics to grow its stockpile of BTC including leveraged trading, taking on structured debt, and issuing more equity, further enabling the purchase of more BTC. Strategy also packages and sells a variety of financial products designed to offer investors exposure to Bitcoin price action without having to endure the operational complexity of holding the asset itself and with the ostensible strategic and decision-making advantage of experienced and insightful management.

Because of these strategic and tactical advantages, Strategy stock (ticker sign: MSTR) trades at a significant premium to Net Asset Value (NAV), meaning the value of Strategy stock is higher than value of the assets when you simply add them up. Saylor argues, and eloquently articulates in his company’s earnings calls, a long series of arguments for why MSTR stock should trade for a substantial premium to NAV. Saylor from MSTR’s Q2 earnings call:

I want to explain how we amplify Bitcoin, okay? So we start with 199,000 Satoshis a share. And if we have no leverage, if we have no credit strategy, we couldn't issue credit, then 10 years from now, we've got 199,000 Satoshis a share. That's like an ETF. That's a BTC factor of 1. But if we issue preferred that's equal to 10% of our Bitcoin assets, that's 10% leverage, it turns out that we have 267,000 Satoshis a share at the end of the period because we're not diluting the common stock as rapidly as we're building the Bitcoin. And if we go to 20% leverage, you see you end up with 376,000 Satoshis a share.

Critically, Saylor and STRATEGY’s success has inspired growing legions of variously capitalized companies to follow in their footsteps and focus on crypto accumulation, leading to the emergence of a new class of company, called a Digital Asset Treasury Company, colloquially referred to as a DATCO.

The Sincerest Form of Flattery

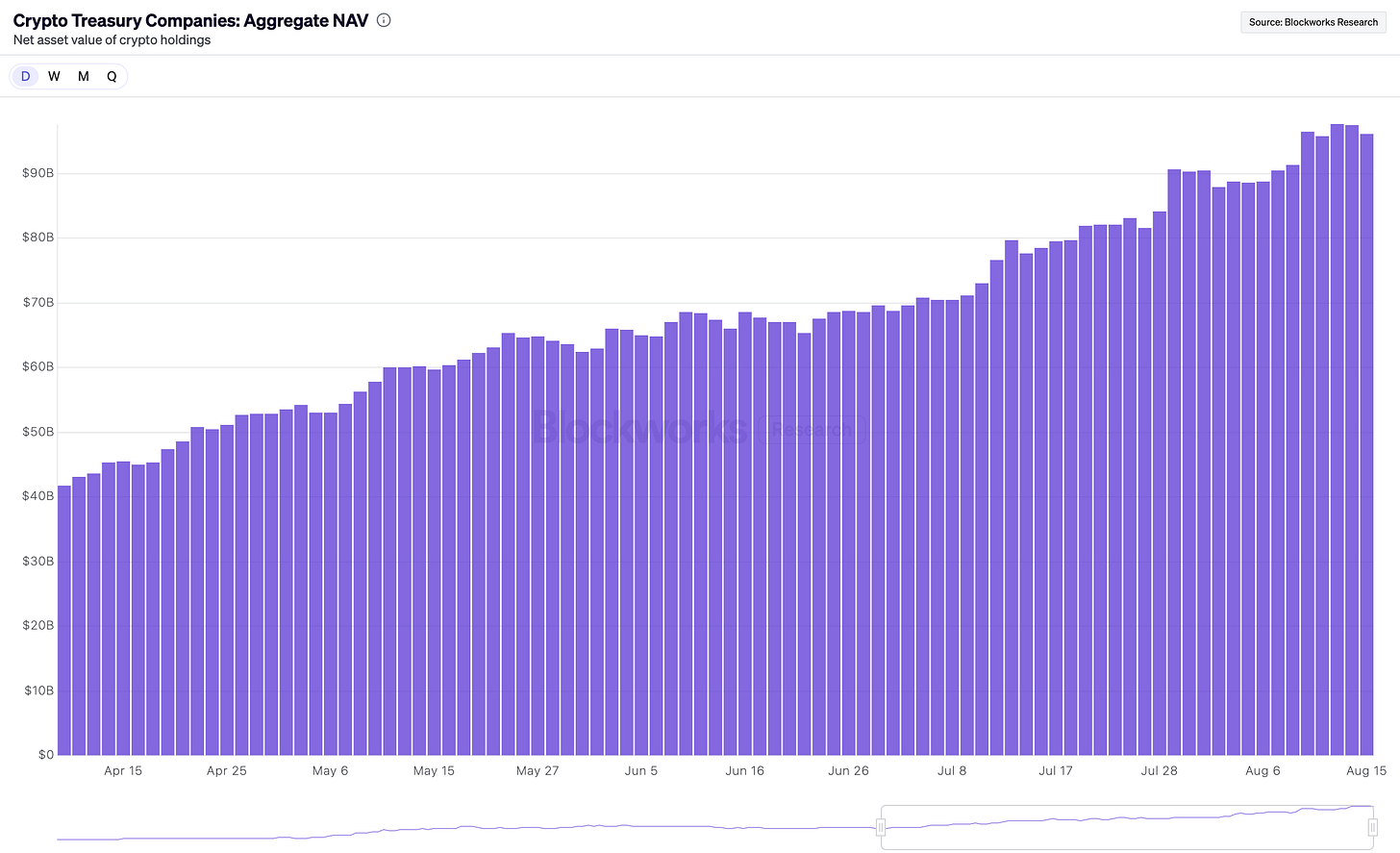

Over the last 18 months DATCOs have spread like wildfire and are snatching up digital assets, particularly Bitcoin, with unprecedented and unrelenting speed. As of this writing, they are believed to collectively hold over $100 billion in assets including 4% of all circulating BTC supply, and a bit over 1% of total ETH.

Each DATCO functions in a slightly different manner, but they share significant strategic and operational similarities, many of them inspired by Strategy itself.

The central function of a DATCO is obviously to hold as much of a digital asset as possible. This is accomplished by creating a virtuous cycle that enables the increasing raising of capital and subsequent accumulation of more assets, ad infinitum. This process is what facilitates the trading of DATCO shares at a premium above NAV. An investor is essentially betting not only on the likelihood of the increase in value of underlying asset, but on the capability of the company to keep acquiring more and more assets.

There are a couple of ways to facilitate this accumulation flywheel. Through an At The Market (ATM) equity issuance program, or through a Private Investment/Public Equity (PIPE) system.

ATM

A DATCO ATM enables a company to flexibly issue equity in the form of public shares (stock) when it wants in the company, bringing in investment capital which is then used to acquire more assets. The complicated, but obvious, concern here if you’re following along closely is that each time new equity is issued, the value of any current shares is diluted. Meaning if you bought a 1/100 share of a random fake DATCO (we’ll call it RFDCO) yesterday, you owned 1% of the companies equity. But if the RFDCO issues more equity tomorrow (say 100 more shares), your ownership stake would be reduced to 0.5% of the companies equity.

This dilution is ameliorated if the DATCO is trading at a premium because each dollar raised through an ATM program buys more crypto per share than it dilutes.

The PIPE

A private investment (PIPE) program is ideal for new Treasury company looking to raise money quickly and get to market. The company negotiates with individual entities looking to own significant equity in a DATCO and takes a sum of investment in exchange for an equivalent share of equity in the venture. Once sufficient investment is acquired, the DATCO will build its asset treasury and go public, allowing other investors to participate and enabling the initial investors to liquidate their holdings. PIPEs have lockup periods, which to-date, are troublingly short. As short as three months. This can create situation where early private investors could potentially earn significant gains completely a the expense of public ones. A negative situation here is again ameliorated by equity shares trading at a healthy premium to NAV.

In both of these as long as things are good…things are good. And since Bitcoin just hit an all time high and the total market capitalization all crypto just eclipsed $4 Trillion for the first time: Things are looking pretty good.

And Things Are Only Getting Bigger

Now, we’re venturing into uncharted territory. We’ve never been through a market period where so many institutions and large corporations have been so invested in holding so much crypto.

In addition to the holdings are Strategy, scores of other companies are racing to accumulate crypto holdings as quickly as they can. From the latest data I can find, there appears to be slightly less than $97 Billion worth of net asset value in crypto holdings spread among these companies

And in addition to the money being held in DATCOs, large centralized supplies of crypto assets, particularly BTC, are a growing trend. A little over a year and a half ago, on January 18, 2024 the Securites Exchange Commission approved for trading the first spot Bitcoin Exchange Traded Funds (ETF). An ETF is an investment fund that trades publicly on a stock exchange similar to an individual corporate equity a la AAPL, META, TSLA. Today, US approved ETFs hold over 1.3 million Bitcoin (over 6% of total supply), worth more than $153 Billion.

And one more group is getting in on the action: the government. The US federal and several state governments have made pledges, and in some cases passed legislation committing them to building strategic stockpiles of digital assets like Bitcoin. In March of this year, the President issued an Executive Order establishing a Strategic Bitcoin Reserve and a Digital Asset Stockpile. Directly, this isn’t that astounding of a directive. Essentially it orders different parts of the government that have Bitcoin (usually gained from civil forfeitures or criminal seizures) to send that money to the Treasury Department where it will be held in one place. But it sets an amazing precedent that Bitcoin is indeed very important, potentially rising to the level of a key “reserve asset.”

Interestingly: I actually got to talk about the idea of Bitcoin as a theoretical reserve asset for a German television program a couple of months ago

But What Happens When Things Change?

This is the key question that we don’t have a great answer for yet. Trying to reason through it, it seems there are two obvious possibilities for the future. One: the price keeps going up or stabilizes for some extended period of time. Two: the price takes a tumble and the increasing amount of bitcoin concentrated in fewer corporate hands leads to quick dumping.

Thinking through option one: it’s of course impossible for the price to continuously move up and to the right without setback. One, that’s not how markets work generally, and it’s definitely not how crypto works. I have great confidence that the price of Bitcoin will far surpass its recent new all time high of $124,450 on Thursday, August 14. It could even maintain it’s current level or venture higher for an extended period of time. I developed a theory about crypto and traditional equities market correlation during my Lucrum times that has borne out nicely: As the crypto market matures it will move from uncorrelated to tightly correlated to eventually become a key leading indicator of the broader market. I.e. What happens in the broader market will happen earlier, and faster, in crypto. If we have a significant interest rate change in the near future there could be even more reason to believe the good times will keep rolling.

But the mere thought of a never-ending euphoric market upswing insists upon imagining the opposite outcome.

Digital Asset Treasury Companies are typically publicly traded corporations, which means the management has a set of fiduciary duties which usually includes doing everything possible to ensure shareholders don’t lose money. And many of these companies are using leverage or even taking on debt to acquire more assets. If the BTC market begins to head south it’s hard to imagine them holding on for dear life. They are going to sell, and in a hurry.

This is the all time price chart for Bitcoin. Zoomed out this way over more than a decade, it looks absolutely phenomenal. Because it is. This is the movement of one of the best performing financial assets of all time. But if you zoom in on one of several periods, the chart becomes horrifying. The price went from a high of over $17,000 in 2017, to a low of $3,400 the next year, not reaching that 2017 peak price again until the pandemic. In 2021, the price went from a new high over $60,000 and was cut in half over just a three month period. These swings are huge, and potentially downright unbearable for an organization not adequately structured to ride the wave.

Governments, especially those as well capitalized as the United States can easily weather a Bitcoin downturn without selling. Strategy has successfully weathered downturns before, and continued to thrive. Unlike the majority of other DATCOs through, Strategy has figured out how to marry their treasury building with a real revenue generating business. It was software solutions, and now it’s a variety of financial products yielding exposure to Bitcoin for investors with different interests and risk tolerances. The majority of DATCOs do not have this; their only “product” is non revenue generating equity offering exposure to the treasury. And that equity offering is perpetually diluted as more equity is issued to fuel the purchase of more assets.

Can The Market be Mastered?

Financial engineering is real; but it cannot outpace market reality forever. But have the managers behind this rising crowd of companies really figured out how to build an endless money machine? Strategy has found a model that fuses treasury building with real business lines, but most DATCOs are essentially leveraged bets on the permanence of Bitcoin’s upward trajectory. Whether this represents a sustainable innovation or just the latest expression of financial excess remains to be seen. What is certain is that DATCOs are accelerating the integration of Bitcoin into the corporate and even governmental mainstream. The stakes are far larger than any single company, or even one cycle; they will shape how digital assets fit into the global economy in the decades ahead.