A Dollar on the Blockchain: What a GENIUS Idea

An important crypto bill is moving through Congress. Here's my take.

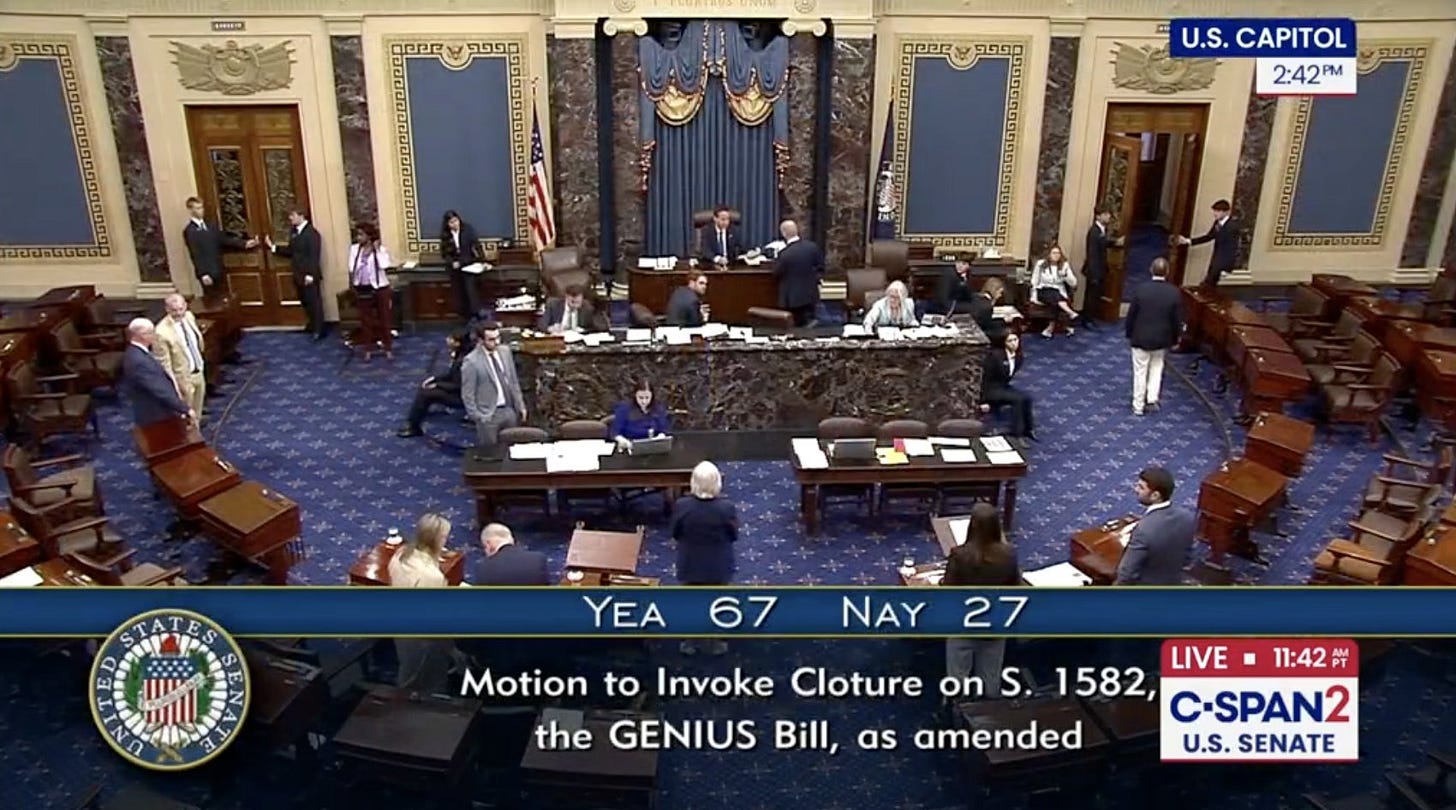

(NOTE: The United States Senate is about to pass a bill regulating stablecoins - the body’s first major crypto focused bill. If you’re reading this after June 17, 2025…it’s probably already happened. ALSO: I previously published a truncated version of this post on Twitter (X) if prefer a version that’s less than half as long)

Getting a Grip on Stablecoins

You may have heard in the news that the President wants to make the United States the ‘Crypto Capital of the World.’ Depending on your individual digital asset familiarity or inclination, that idea could take on one of myriad different possibilities in your imagination. If you care deeply about the President’s private business dealings, then perhaps you think making America a Crypto Capital is synonymous with ending all financial regulation and enabling a new level of unlimited executive enrichment.

If you believe that crypto is a phony technology - a solution in search of a problem - then you might think that Congress spending any time considering associated legislation is time wasted that could have been spent debating important issues like the ‘crisis’ at the southern border, or global trade imbalances, or artificial intelligence. And if you are extremely crypto literate and have followed the ups and downs of an American industry with no domestic endorsement then you likely are breathing a sigh of relief that finally: regulation is coming. Multiple things - sometimes even seemingly contradictory things - can be true at once, and reality is largely an exercise of perception. But if you fall into the last camp, then welcome; you’re in good company.

The first stop on the agenda to make America the Crypto Capital is creating a regulatory framework for stablecoins, a specific kind of digital asset that is designed to maintain a predictable price over time.

Today I’m diving into what that is, why it exists, why regulating it is worth valuable floor time in the Congress, and why you should care.

0 to 100 (Real Quick): Why Blockchains Matter

Blockchains are important, in short, because they are fundamental technological building blocks of the next era of the Internet. A blockchain is a very specific kind of software protocol (a complex set of rules and instructions) that enables the transparent and verifiable movement of value across a network, without the need for a central intermediary like a company, a bank, or a government. And particularly meaningful, blockchains and their attendant infrastructure allow for the independent custody and safekeeping of that value. In short: blockchains change how information moves in a manner that prioritizes the rights of the individual over that of the middleman.

Blockchain networks are composed of a suite of participants, including infrastructure and service providers, ranging from large companies to hobbyist level individuals who execute the many tasks that support the ongoing viability of the network. Those entities can be rewarded in something called a token, or in more common parlance, a ‘coin.’ When someone says the word ‘bitcoin’ they could be talking about one of two things; the network called Bitcoin OR the attendant native token FOR that network, also called bitcoin. This sounds odd, but it’s pretty ingenious. Crypto networks incentivize network participants to provide infrastructure, maintenance, and services by rewarding them with a native token, which can be used on that network (or sold in a secondary marketplace) further incentivizing participation in the network, growing its user base and strengthening its resilience.

It’s the secondary marketplace, as I mentioned above, where you likely first heard anything about Bitcoin or crypto. Because there is inherent value for a token within a specific context (ie when sending bitcoin transactions across the Bitcoin network) someone is willing to pay for that asset, which gives it a price denominated in some other asset, such as the US Dollar. Over the last dozen years or so, a robust global market has developed for the buying, selling, and trading of these tokens. In the United States you can, with relative ease, link your banking account to one of several centralized exchanges such as Coinbase, Kraken, or Robinhood, and swap your dollars for some market price variable amount of a given token, such as Bitcoin or Eth (the native token for the Ethereum network).

The problem here is that markets are not stable things, and the crypto market is extremely volatile with intraday percentage swings in the 10s or even 100s of percent happening across assets on a regular basis. A secondary market for the trading of completely digital assets that only a relatively small number of ecosystem participants (mainly those infrastructure and service providers mentioned previously) make real use of on a day to day basis is going to be unpredictable. (Note: though this class may be small on a relative scale to the number of total people involved in an ecosystem, this infrastructure class is orders of magnitude larger, with the potential for exponential further growth, than the class that constitutes the infrastructure providers for the dominants modern internet, and its critical that they exist and have a real need for the native assets).

As the crypto ecosystem has grown over time, more and more people make use of blockchain networks for trading and speculation and, increasingly, for more traditional financial transactions like payments and cross border remittance.

This prosaic function combines with the unpredictable volatility of crypto prices and presents the need for an obvious innovation: a reliably valued crypto asset: a stable coin.

What is a Stablecoin?

A stablecoin is a type of digital asset; a virtual token that lives on a blockchain. Different from other types of digital assets, stablecoins are designed to maintain a steady value, particularly in relation to a specific reference asset. There are several different kinds of stablecoins, but for our purposes today, let’s focus on the fiat-backed variety.

A fiat-backed stablecoin, such as USDC, issued by the (now publicly traded!) company, Circle, is a digital asset pegged to an offchain reserve asset (the US Dollar) that is intended to provide a reliable store of digital value and medium of exchange.

This mirroring of an asset on the blockchain is accomplished by having a robust reserve storage, issuance, and transparency regime that enables users to trust that there is indeed an offchain dollar supporting the value of the onchain token.

In the case of USDC: Circle takes cash transfers and then deposits that money with its banking partners who store the money on Circle’s behalf. Once money is received, Circle signs an onchain transaction minting (creating) an equivalent amount of USDC ($1,000 in the bank yields 1000 USDC) on the blockchain. Specifically, it can be natively minted to 14 different blockchains (including Ethereum, Solana, and Base). Once minted onchain USDC can be flexibly stored, sent, received, and traded, like any other digital asset.

How are Stablecoins Used?

The majority of stablecoin transaction volume on a daily basis is for trading of one sort or another. Stablecoins elegantly blended the flexibility, transparency, and permissionlessness of crypto with the price steadiness of traditional currency. Financial trading and speculation, while perhaps not the highest ultimate usage of the technology, has emerged as the clear first ‘killer app’ use case of crypto. And this is not a bad thing. The organic interest in the space driven by the market has incentivized rapid evolution of the technology, enabling the privacy enhancing and reliability innovations that will make a truly decentralized internet possible.

Beyond trading, stablecoins have found product-market-fit for both payment for goods and services and as the medium for cross-border transactions. Stablecoins can settle (actually move from one party’s ownership and control to another’s) in near real-time, as opposed to a more traditional credit card payment, for example, which usually takes somewhere between one and three days. For retail or business transactions, its clear why this is an advantage.

Cross-border payments, or remittances; the sending of money often from one family member to another, has long been a heralded benefit of crypto, and stablecoins are making them work in a meaningful way. Stablecoins facilitate access to foreign currencies for people whose domestic money might not have the reliability of high quality currency like the US Dollar. More traditional remittance rails like Western Union can charge high percentages of transactions in fees (5-10%), eating up much of the value being sent. Crypto makes this much cheaper, with fees dwindling often to 1% or below.

A Question of Trust

The composition and technical characteristics of a fiat-backed stablecoin can vary widely, depending on the reliability of the institutions used to hold deposits, the composition of the deposits, the timely accessibility of those deposits, the soundness of smart contracts used to issue tokens onchain, and the amount of trust held by the market that this system is in fact sound.

A key element of truly decentralized infrastructure is that you do not have to put your trust in a centralized entity. Trust is earned through transparency and through the quality of open source software.

The issuance and maintenance of an asset backed stablecoin creates a delicate circumstance where trust is required to maintain equilibrium and ensure reliable operation and steady trading on open markets. And because this kind of trust is required, stablecoin issuance is an area where sound regulation is acutely relevant.

Enter GENIUS

For years, stablecoin legislation has been deemed the ‘low-hanging fruit’ of crypto policy. Stablecoins are relatively straightforward to understand, the need is for regulation is particularly obvious, and the usage has grown so significantly. Over the last few years, members of congress have put forward various stablecoin initiatives, with the most significant being a bill that passed through the House Financial Services Committee led by then-chair Patrick McHenry.

In February of 2025, a bipartisan cohort including senators Bill Hagerty (R-TN), Cynthia Lummis (R-WY), Kirsten Gillibrand (D-NY), and Chair of the Banking Committee Tim Scott (R-SC) introduced the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act to create a regulatory framework for the issuance and use of payment stablecoins in the United States. The introduced bill emerged from a discussion draft of text Hagerty shared with the public the previous fall.

The GENIUS Act seeks to answer a suite of critical questions about stablecoins and create a regulatory framework for the issuance and usage of the digital assets in the United States. The bill is designed to regulate a very specific kind of stablecoin, what the text refers to as a ‘payment stablecoin;’ a 1:1 reserve backed token designed for payment or settlement where the issuer is obligated to maintain a stable value.

The text lays out details for a long list of other critical points, clarifying who can become a permitted payment stablecoin issuer and what the requirements are. It articulates just who their regulators are and how oversight is supposed to work. The bill even lays out what will happen in the case of the failure or bankruptcy of an issuer and what issuers are required to do to minimize illicit uses of their technology.

Critically, GENIUS Act didn’t take its current form overnight. In May, the bill failed in its first procedural vote on the Senate floor generating fear, uncertainty, and doubt about the bill’s chances of success. But, rather than allowing that to be the end of the conversation, a group of lawmakers led by Senators Mark Warner and Ruben Gallego returned to the negotiating table. Over the following weeks, Republicans and Democrats worked together to refine and strengthen the text.

Lawmaking is often messy, confusing, and unseemly — sausage-making, as the old saying goes. No one can guarantee the smooth passage of a bill from its original conception to the President’s desk. But good bills — the ones that survive and succeed — often get stronger along the way. They evolve as they pass through more hands, respond to more perspectives, and reflect a fuller picture of the problem they’re designed to solve.

That’s what happened with GENIUS. The bill evolved. It matured. It became something that can actually pass the Senate and move toward becoming law. And it did so not by compromising its purpose, but by leaning into the process.

Why Passing GENIUS Matters

Getting a law on the books matters. Because in the absence of clarity, crypto entrepreneurs and innovators have been stuck in limbo — building in ambiguity rather than within a rules-based framework. The U.S. needs solid, modern regulatory guardrails that empower its builders to do what they do best: BUILD.

The GENIUS Act is more than just the first comprehensive federal law governing stablecoins; it’s a signal that the United States is prepared to lead in the next era of digital finance. It replaces a void with a vision — offering clear standards for issuers, meaningful protections for consumers, and enforceable guardrails against abuse. It acknowledges that stablecoins are already here, already used, already valuable — and brings them into a regulated framework that reflects both their promise and their risks.

Critically, GENIUS does all of this while preserving space for innovation. It threads the needle between safety and freedom — imposing oversight without stifling open development. Its standards for redeemability, disclosures, reserve backing, and operational integrity don’t just protect users — they legitimize the entire category in the eyes of the financial system, policymakers, and the public.

And it does something else too: it restores U.S. credibility on the global stage. Other countries are not waiting. The EU, Japan, Singapore, and the UK have all moved forward with digital asset regulations. Without action, the U.S. risks ceding leadership in a sector it helped pioneer. With GENIUS, we step back into the arena — with a framework that is bipartisan, pragmatic, and future-facing.

Passing the GENIUS Act means showing the world that American innovation doesn’t just start movements — it finishes what it starts. It means setting standards others can follow, and giving our builders the clarity they need to create the next generation of internet-native finance. It means treating crypto like what it is: not a speculative fad, but a core layer of tomorrow’s financial and economic infrastructure.

GENIUS is ready. It’s been debated, revised, refined. It’s the result of real compromise and genuine collaboration. And it is now poised to become law. Let’s pass it — and in doing so, lay the foundation for the United States to remain the home of financial innovation for the 21st century and beyond.